In recent years, the world has witnessed the global economy causing tremendous stress on traditional institutions, pushing them to the point of failure and sparking concerns about the reliability of long-standing banking systems.

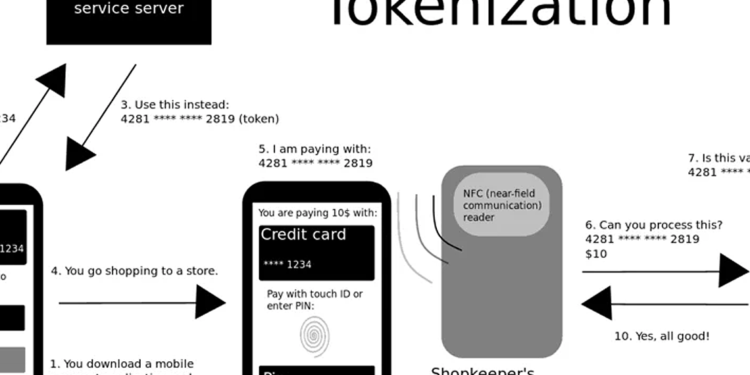

In response to these uncertainties, blockchain technology has emerged as a promising alternative, offering tokenized assets that present a robust and reliable alternative to traditional avenues.

Let’s explore why tokenized assets can be considered viable alternatives during periods of economic stress using statistics, real-world examples, and insights from the blockchain revolution.

- History has shown us that traditional banking institutions and systems are susceptible to vulnerabilities during stressful economic conditions.

- Unlike traditional institutions that operate on a centralized model, blockchain distributes data across a network of nodes, making it virtually impossible for a single point of failure to bring down the entire system.

- Blockchain’s transparency ensures that all transactions are recorded and publicly accessible. This transparency significantly reduces the risk of fraudulent activities and mismanagement.

- With tokenized assets, individuals have direct ownership and control over their assets. In traditional systems, account holders relinquish control of their assets to large institutions.

- During a banking crisis, traditional institutions often impose withdrawal restrictions and liquidity constraints, leaving account holders unable to access their funds. In contrast, tokenized assets can be traded on various decentralized exchanges, ensuring liquidity at all times.

The Perils of Traditional Systems

Recent history has shown us that traditional banking institutions and systems are susceptible to vulnerabilities during stressful economic conditions. But this hasn’t always been the case.

According to statistics, bank collapses were uncommon in the early 2000s. From 2001 to 2007, the U.S. saw an average of just 3.57 bank failures per year.

However, the tides dramatically shifted when the U.S. officially declared a recession in December 2007. The period from 2008 to 2012 witnessed a staggering surge in bank failures, averaging around 93 per year.

Out of a total of 565 cases between 2000 and 2023, a striking 82% — amounting to 465 failures — occurred during these five years. The year 2010 reached an unprecedented peak with 157 cases, surpassing the combined number of cases witnessed in the entire decade leading up to it.

How Tokenized Assets Provide Reliability

- Decentralization

Tokenized assets are built on blockchain technology, a decentralized and immutable ledger system. Unlike traditional institutions that operate on a centralized model, blockchain distributes data across a network of nodes, making it virtually impossible for a single point of failure to bring down the entire system. This decentralization enhances the resilience of tokenized assets.

- Transparency

Blockchain’s transparency ensures that all transactions are recorded and publicly accessible. This transparency significantly reduces the risk of fraudulent activities and mismanagement. Additionally, cryptographic techniques protect the data within the blockchain, making it highly resistant to tampering and unauthorized access.

- Ownership Control

With tokenized assets, individuals have direct ownership and control over their assets, unlike in traditional systems where account holders relinquish control to institutions. Tokenization empowers users with private keys, enabling them to manage their assets independently.

- Liquidity and Accessibility

During an economic crisis, traditional institutions often impose withdrawal restrictions and liquidity constraints, leaving account holders with limited access to and use of their accounts. In contrast, tokenized assets can be traded on various decentralized exchanges without the need for mediation by large institutions.

Investors can convert their assets into stablecoins or other cryptocurrencies, enabling them to retain value and access their funds when needed.

Real-World Example: Banking Crisis vs. Tokenized Assets

During a hypothetical economic crisis, let’s consider two individuals — Alex and Sarah — who have diversified asset portfolios. Alex owns traditional assets like stocks and bonds through a brokerage, while Sarah owns tokenized assets on a blockchain platform.

- Freezing of Assets

As the crisis unfolds, the traditional bank faces liquidity issues and is forced to freeze customer accounts temporarily. Alex finds himself unable to access his assets, leaving him stranded during the crisis. On the other hand, Sarah, who holds tokenized assets, can continue to access, trade, or convert her assets into stablecoins or cryptocurrencies, offering her a lifeline amidst the crisis.

- Counterparty Risk

In a traditional system, depositors face counterparty risk, meaning their assets are highly dependent on the holding institution’s stability. If the institution fails, account holders may lose a portion or all of their assets. Tokenized assets, however, are not subject to counterparty risk. Sarah’s holdings on the blockchain are protected by smart contracts and cryptographic techniques, reducing the risk of losing her assets due to a single entity’s failure.

- Transparency and Auditability

Traditional banks are held accountable by government regulations to maintain a high level of transparency when it comes to customer assets. On the other hand, blockchain technology natively offers complete transparency and audibility by virtue of all records and data being on-chain all the time. Sarah can verify her tokenized asset holdings and transactions on the public blockchain, ensuring that her assets remain protected and accounted for at all times.

Summing it Up

Tokenized assets provide a compelling alternative to traditional banking systems during times of crisis. Decentralization, transparency, ownership control, and liquidity offered by blockchain technology enhance the protection of assets in the face of economic turmoil.

While risks can never be completely eliminated, the blockchain revolution has introduced a new alternative to people, allowing them the ability to choose where and how they want to store their assets in case of an emergency.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Always conduct thorough research and consult with a qualified financial advisor before making investment decisions.